|

MicrostockGroup Sponsors

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

Topics - Jo Ann Snover

1

« on: October 26, 2023, 11:06 »

Shutterstock will be announcing their Q3 results next Tuesday (31 Oct) so perhaps it's not surprising that they are banging the drum about new AI features in the Shutterstock library: https://www.prnewswire.com/news-releases/shutterstock-integrates-creative-ai-into-library-of-700m-images-to-offer-first-ever-marketplace-of-fully-customizable-stock-301967961.htmlA couple of days ago, one analyst report said the results weren't expected to be good: https://finance.yahoo.com/news/analysts-estimate-shutterstock-sstk-report-140042530.html"Wall Street expects a year-over-year decline in earnings on higher revenues when Shutterstock (SSTK) reports results for the quarter ended September 2023. While this widely-known consensus outlook is important in gauging the company's earnings picture, a powerful factor that could impact its near-term stock price is how the actual results compare to these estimates." Blathering on about "infinite options", the CEO opined: "This is an unprecedented offering in the stock photography industry," said Paul Hennessy, Chief Executive Officer for Shutterstock. "Now, creatives have everything they need to craft the perfect content for any project with AI-powered design capabilities that you can use to edit stock images within Shutterstock's library, presenting infinite possibilities to make stock your own." It's in beta, but considering the abysmal quality of the Dall-E output that is currently in their AI generated section, it'd have to be much better to actually be useful to customers Babies - Typewriter - Podcast illoThey will give a demo 9 NovEdited mid-day Friday to note that SSTK (Shutterstock's stock) is around $34.20 which is what it was at the beginning of June 2020 - when Stan Pavlovsky pursued his plan to boost the stock price by looting contributor royalties. Or "margin optimization" as they referred to it. The stock ended 2020 around $70 and reached as high as $123 in Nov 2021. Except for a brief lurch up to $70 at the beginning of this year, it's been downhill since.

2

« on: September 25, 2023, 12:42 »

I saw an image of the Sept 11 2001 attack in New York City when looking at new approvals in Adobe Stock's genAI collection today. https://stock.adobe.com/search?creator_id=211304520&order=creation&k=%22september+11%22+-flagI first noticed the theatrical "explosions" in the scene. I noticed the buildings didn't look like New York. I noticed that One World Trade Center - which was built after the twin towers were destroyed - was featured in several of the images supposedly from 2001. Then I thought some more about this being on another level of unacceptable from the thousands of other accepted images supposedly of other places which are unreal and inaccurate. This just feels exploitive - it's a cheap imitation of something very real and still painful for so many people. I think all of these images should be removed. Anyone else have an opinion on this type of content? I realize as contributors we have very little input on Adobe Stock's policies, but possibly they haven't thought about it either and possibly it just needs to come to their attention? Here are just a couple to look at    And there's this one - careless and stupid, but not offensive in the same way

3

« on: September 25, 2023, 09:57 »

https://investors.gettyimages.com/news-releases/news-release-details/getty-images-launches-commercially-safe-generative-ai-offeringhttps://www.gettyimages.com/ai/generation/about"Customers creating and downloading visuals through the tool will receive Getty Images� standard royalty-free license, which includes representations and warranties, uncapped indemnification, and the right to perpetual, worldwide, nonexclusive use in all media. Content generated through the tool will not be added into existing Getty Images and iStock content libraries for others to license. Further, contributors will be compensated for any inclusion of their content in the training set." https://www.theverge.com/2023/9/25/23884679/getty-ai-generative-image-platform-launchhttps://arstechnica.com/ai/2023/09/getty-images-subscribers-to-get-access-to-ai-image-generator/https://gizmodo.com/getty-new-art-generator-trained-on-contributors-1850866540"On an annual recurring basis, we will share in the revenues generated from the Getty Images AI Generator with contributors whose content was used to train the AI Generator, allocating both a pro rata share in respect of every file and allocating a share based on traditional licensing revenue. The first payment is expected to be in late 2024 for the year October 2023-September 2024. We expect this to represent a new revenue stream for contributors that is additive to the licensing benefits you already enjoy with Getty Images." From the FAQ: "What are Getty Images� rights to use my/contributor content for AI training? Our contributor agreements enable Getty Images to license your content in a broad range of uses, existing or emerging, including training data for AI and machine learning uses." https://apnews.com/article/getty-images-artificial-intelligence-ai-image-generator-stable-diffusion-a98eeaaeb2bf13c5e8874ceb6a8ce196The Verge article talks about the quality of the results - they got to try it out - and their screen shot looks miles better than Shutterstock's DALL-E 2 equivalent, at least based on what shows up in the generative AI collection on SS. "I got a hands-on look at Generative AI by Getty Images and got to play around with the tool for a bit. I mainly wanted to see how it generates photos, rather than illustrations, to test out how close to an actual Getty-watermarked picture it can get. And the photos look better than expected. Stock photos already have an artificial, soulless quality to them, and I was not surprised that some of the first few images the tool generated also felt... devoid of feeling. ... Getty�s tool did well at rendering realistic-feeling human figures. I prompted it to create a photo of a ballerina in an arabesque position (standing on one leg with the other lifted behind) on a stage with a slightly blurred background. The photos I got felt more human than when I tried the same prompt with Stable Diffusion, and the Getty image fooled my friends when I texted it to them. It's clear Getty�s model trained not just on illustrated art but on actual photos. " https://techcrunch.com/2023/09/25/getty-images-launches-an-ai-powered-image-generator/https://www.axios.com/2023/09/25/getty-images-ai-creation-toolhttps://fortune.com/2023/09/25/getty-images-launches-ai-image-generator-1-8-trillion-lawsuit/"The difference, said Getty Images CEO Craig Peters, is this new service is �commercially viable� for business clients and �wasn�t trained on the open internet with stolen imagery.� He contrasted that with some of the first movers in AI-generated imagery, such as OpenAI�s DALL-E, Midjourney and Stability AI, maker of Stable Diffusion. �We have issues with those services, how they were built, what they were built upon, how they respect creator rights or not, and how they actually feed into deepfakes and other things like that,� Peters said in an interview." https://petapixel.com/2023/09/25/getty-images-makes-u-turn-as-it-launches-its-own-ai-image-generator/(emphasis mine) - I like that way of putting the difference between generative AI and photographs "However, Getty Images will not allow the material made on its new generative AI tool into its content libraries which will be reserved for �real people doing real things in real places.� " https://www.business-standard.com/world-news/getty-images-working-with-nvidia-to-debut-its-own-ai-image-generator-123092501302_1.htmlhttps://www.engadget.com/getty-is-going-to-offer-ai-generated-images-after-all-140138829.htmlhttps://www.zdnet.com/article/can-microsoft-recover-from-the-collapse-of-its-surface-business/Edited Sep 26 to add a few more links to press coverage of this announcementhttps://decrypt.co/198660/getty-images-launches-safe-generative-ai-image-toolFrom the context, "user-generated" is referring to Getty's customers for their AI tool, not contributors to their "pre-shot" collection "Getty Images says user-generated images and prompts will train its AI models. Still, as Peters explained, user-generated images will not be uploaded to the Getty Images website or licensed by the company. �So what you generate and the corresponding outputs are yours to decide whether you want to use or not, but we are not bringing those images back into what we call our pre-shot catalog,� Peters said. �And we don't accept AI-generated images into our pre-shot catalog because we don't know the provenance of what it was created with.� " https://www.technologyreview.com/2023/09/25/1080231/getty-images-promises-its-new-ai-doesnt-contain-copyrighted-art/"Tech companies claim that AI models are complex and can�t be built without copyrighted content and point out that artists can opt out of AI models, but Peters calls those arguments �crap.� �I think there are some really sincere people that are actually being thoughtful about this,� he says. �But I also think there�s some hooligans that just want to go for that gold rush.� " https://www.forbes.com/sites/johanmoreno/2023/09/25/getty-images-debuts-generative-ai-solution-for-copyright-safe-image-generation/https://digiday.com/media/getty-images-gets-into-the-generative-ai-race-with-its-own-image-platform/"�There�s technology for technology�s sake, there�s break things and move fast and ignore other people�s rights � and this doesn�t do [any of] that,� Getty Images CEO Craig Peters told Digiday. �It presents a real meaningful, high-quality solution to customers, which is what they�ve been asking for.� Similar to competitors like Shutterstock and Adobe, Getty Images offers full indemnification for commercial use of AI-generated images. However, unlike some others, Getty�s AI model is trained on only its own licensed content � a selling point for anyone worried about the range of copyright concerns that plague some other AI platforms. Customers want to embrace generative AI without having to �absorb a massive amount of IP risk in doing that,� Peters said. He added that the plan isn�t to replace human contributors, but rather to �index on creativity� with �another tool in the creator�s toolbox.�" https://www.artnews.com/art-news/news/getty-releases-ai-image-maker-trained-on-own-data-1234680408/https://www.digitalmusicnews.com/2023/09/25/getty-images-generative-ai-platform-music-speculation/"The concept of unleashing machine learning on a controlled copyright collection is interesting � with a very similar concept rumbling in the music industry. That music-focused model is expected to debut within several weeks, with DMN prepping the story now (stay tuned)."

4

« on: September 04, 2023, 16:25 »

5

« on: August 31, 2023, 12:24 »

It might seem fruitless to urge new rules for genAI content when almost none of the current ones are being followed or enforced, but here goes. Some locations - oil refineries, factories, research labs, outer space - are hard to access for stock photographs. That makes them ripe targets for the genAI factory producers who churn out content based on copying someone else's title and making it a prompt. I know Adobe says "don't do that" but there's a lot in the collection already. I took a look at some examples of robotic arms in a solar panel factory - or what purported to be that. I then realized I don't know anything about the details of solar panel manufacturing, but did a little searching online to confirm a gut feeling that the genAI copycat content was rubbish. It looks high-tech-ish and robot-ish but it isn't real and arguably would harm the credibility of any buyer who licensed it to use with an article about increasing use of solar panels. While looking at the human-produced solar panel factory images on Adobe Stock I recognized some of the prompts as ones used for genAI images. I took two and did searches and made screen shots to give a visual example of what I'm talking about. It's possible this content would be OK if Adobe put a visual label on all genAI content in search results - to allow anyone who needs accurate images to avoid these. It's possible it should go on the no-no list - like specifying specific cities or famous places. The temptation is significant because of the lack of supply of the real thing, but I'm not sure that is enough to make this type of fake stuff OK to offer to buyers. And I'm not a fan of leaving it up to the buyers - how on earth are they supposed to separate the snazzy looking image with the copied title from the real thing? I think stock agencies accepting genAI content need to think hard about setting buyer-friendly, trustworthy, sustainable policies about these sorts of issues It is especially galling that the sort orders of "Relevance" and "Featured" put some of the newer genAI items ahead of the real images of solar panel factories. The copied titles from the original (human-generated) content:Wide Shot of Solar Panel Production Line with Robot Arms at Modern Bright Factory. Solar Panels are being Assembled on Conveyor.Large Production Line with Industrial Robot Arms at Modern Bright Factory. Solar Panels are being Assembled on Conveyor. Automated Manufacturing FacilityClick for larger version - first one and first four images, respectively, are the human created photos.   Note: I can't be certain all the genAI images are all wrong, but I looked at a bunch of images online and accompanying articles about solar production and did not see anything that looked like what Midjourney (or whoever) came up with. Given that reviewers can't be expected to know the innards of a whole variety of factories or industrial processes either, I'd argue that points towards disallowing this type of content altogether

6

« on: August 16, 2023, 10:32 »

https://www.theverge.com/2023/8/16/23834146/adobe-express-firefly-generative-ai-release-design-app"The generative features in Adobe Express are neat when they actually work, but they�re not in the same league as other Firefly-powered features like Photoshop Generative Fill." I spent a little time with Firefly beta a couple of days ago to see if it had improved since my last experiments and IMO it's just not usable yet. This page still says (beta) for the generative AI features: https://www.adobe.com/express/?clickref=1100lxHLAxSQ&mv=affiliate&mv2=pz&as_camptype=&as_channel=affiliate&as_source=partnerize&as_campaign=skimlinks_phghttps://www.techradar.com/computing/artificial-intelligence/adobe-express-adds-firefly-ai-to-its-free-plan-for-next-level-creativity"We do want to warn you to not expect too much from this rendition of Firefly. Like a lot of other free image generators, the results can look rather nightmarish..." https://www.redsharknews.com/adobe-express-with-firefly-moves-out-of-betahttps://petapixel.com/2023/08/16/new-adobe-express-is-available-now-and-built-for-everyone/https://www.windowscentral.com/software-apps/adobe-firefly-generative-ai-is-now-available-to-all-adobe-express-usershttps://appleinsider.com/articles/23/08/16/adobe-express-with-ai-firefly-app-is-available-worldwidehttps://www.businesswire.com/news/home/20230816666128/en/All-New-Adobe-Express-With-Firefly-Brings-Generative-AI-to-Creators-Worldwidehttps://www.bakersfield.com/ap/news/all-new-adobe-express-with-firefly-brings-generative-ai-to-creators-worldwide/article_eb6f740e-e550-5464-b83d-9500d0a3b0a0.htmlhttps://www.computerworld.com/article/3704794/adobe-express-with-generative-ai-exits-beta-available-now.htmlOn copyright issues: "One interesting note is that while Adobe has been working intensively with AI to augment its creative products, when it comes to generative AI the company was early to recognize the need to avoid copyright abuse. Already, we�ve seen instances in which assets created by these tools have abused the copyright held by creatives, and given the company�s position as a provider of creative solutions for creative users it was smart to think about how to avoid being in such a position.

This is why Firefly and the gen AI used in Express and its other products has been trained on unique data, rather than copyrighted assets. Given that inadvertent abuse of other people�s intellectual ideas has now been recognized as a big problem, it�s reassuring Adobe got to this early."On Firefly: "The generative AI features are also really promising, generating some great results, though I would advise against using it to create faces, hands, or groups of people � the tech finds it hard to create those convincingly."Usable or not, contributors were told that when Firefly was out of beta there would be a compensation model for us - I haven't heard anything from Adobe Stock about compensation for data training

7

« on: August 08, 2023, 13:05 »

I've spent way too much time looking at AdobeStock's fast-growing genAI collection and regularly have that flash of recognition for a face - a sense that I'm sure I've seen that person before. I've tracked a couple of these down using AdobeStock's excellent "Find Similar feature and it's as if there are a handful of models for each age/ethnicity group and everyone's using this tiny set of people. Their pictures are everywhere! I don't think this is copying another's images; I think it's the limits of the engines contributors are using to create content. There are now 13,860,209 items in the genAI collection (obviously not all people) and apparently a limited set of pretty faces to draw on. Each one of my examples is from a different contributor. Here's a selection from 24,355 similar images to the top left item I saw this afternoon (click to see full size)  You can see the entire set of images here. I'm sure people will point out that photographers can share models in the real world too, but the issue is scale - AI can just pump out near-endless quantities of this stuff. From a buyer's point of view, I don't want every other company's ad to look so similar, and that's going to become extraordinarily hard. The guy's impossibly fit, tanned and handsome - and multi-talented, well traveled and perennially happy. Ideal stock model if he could ration his appearances just a little

8

« on: August 01, 2023, 16:24 »

https://investor.shutterstock.com/news-releases/news-release-details/shutterstock-reports-second-quarter-2023-financial-resultsI haven't found a freely-available transcript of this morning's earnings call, but I'll update this if I do. This article gives an overview of why investors weren't happy with the results: https://stockstory.org/nyse/sstk/earnings/shutterstock-nysesstk-misses-q2-revenue-estimates"Stock photography and footage provider Shutterstock (NYSE:SSTK) missed analysts' expectations in Q2 FY2023, with revenue flat year on year at $208.8 million" "Shutterstock's revenue growth over the last three years has been unremarkable, averaging 9.53% annually. This quarter, Shutterstock reported rather lacklustre 0.95% year-on-year revenue growth, missing analysts' expectations." " In addition, the company's gross margin also deteriorated." Bear in mind that the crowing about subscriber growth omits mentioning what's noted in the detailed statements: Pond5 numbers were included for the first time in Q2 2023. I also think there's been conversion of existing customers from credit packs to subscriptions, which means it can be counted as subscriber growth, but it isn't really customer growth. See all the charts in the appendix at the bottom of this investor page https://content.shutterstock.com/investor-report/index.htmlOne number that stood out to me was the number of paid downloads had dropped 38.5 million, down from 42.7 million in Q1 2023 and 43.4 million in Q2 2022. Enterprise revenue was up, but E-commerce revenue was down - 12% lower than the same quarter in 2022. "The decline in E-commerce revenue was primarily driven by continued weakness in new customer acquisition" Enterprise revenue is still smaller than E-commerce and includes "...$17.3 million and $2.2 million, related to our computer vision data partnerships, for the three months ended June 30, 2023 and 2022..." Not sure what those partnerships are, but if they aren't royalty bearing activities, then contributors don't benefit from that type of growth. "The increase in Enterprise revenues was primarily driven by growth in our computer vision data partnerships which generated $17.3 million during the second quarter..." So I take that to mean that income from its stock licensing business was essentially flat and paid downloads were declining - hence the stock price dropping, I guess.

9

« on: July 31, 2023, 11:06 »

https://finance.yahoo.com/news/adobe-could-add-another-25-093249850.html"Adobe Inc.�s blistering rally has further to go, according to Morgan Stanley analyst Keith Weiss, who sees the creative software maker�s shares adding a further 25% over the next year."Right now the stock is up over $20 this morning, at $551.97 From the Yahoo Finance video (emphasis mine): "And taking a look at individual stocks. Adobe shares are popping today. They're at about an 18 month high, in fact. Morgan Stanley said the company is rallying and still has further to go. The bank now giving Adobe its highest price target on the street at $660. That's about 25% upside fueled by optimism over its artificial intelligence strategy."We're over 4 months out from the Firefly announcement in March and although there have been many new "beta" features announced since then, and Firefly itself is still in beta, contributors - upon whose work most of the generative AI strategy rests - still have nothing more than a promise of compensation at some future time for some yet-to-be-determined amount. From the Bloomberg article: "This year�s rally in Adobe�s shares has only really got going since the end of May, with the stock up around 30% in that period as the maker of software such as Photoshop gave investors a glimpse of its AI strategy and calmed worries that it would get left behind by smaller firms specializing in the new technology." The higher their stock goes, the more impatient I get to hear when contributors get our share. I hope Adobe remembers clearly what they said about the importance of commercially safe AI and why their offering is: "At a moment when generative AI has been deemed to have �an intellectual property problem,� Adobe believes that Firefly is the only enterprise offering that �generates commercially viable, professional quality content at speed.� Its first Firefly model, launched in March, is trained on hundreds of millions of Adobe Stock�s licensed images, openly licensed content and other public domain content without copyright restrictions." Edited to add Adobe's stock closed Jul 31 at $546.17; Aug 2nd: $530.30; Aug 3: $523.76

10

« on: July 28, 2023, 18:47 »

It is beyond belief that this image was recently approved - this content puts Adobe Stock and anyone licensing this image at risk. Getty is notoriously tough with misuse of its images. I first noticed this item because of the comically gigantic laptop in front of the mannequin-like worker  Seeing photos on the huge screen - and, surprisingly for genAI, readable text - set off warning sirens in my brain (I've been editing stock images for way too long!) A google search found the two articles and the image credits. Both are credited to Getty - senior couple and laptop handshttps://fortune.com/well/2023/07/23/how-to-stay-fit-as-you-age/https://www.cnn.com/2023/07/22/tech/ai-jobs-efficiency-productivity/index.htmlThe contributor has several other laptop images with photos on the screen, but they're harder to track down (so I didn't). I expect none of them are licensed. If anyone who can post on the Discord thread about "oops" genAI images wants to post this - or a link to this thread - go ahead. I realize it's a bit childish of me, but I am so angry to see any pretense at reviewing standards tossed aside in the frenzy of AI madness. I defy anyone to convince me that a non-AI image like this could ever get approved without property releases for the on-screen content. I've had to provide releases for use of my own images (on walls and screens) so many times...

11

« on: July 26, 2023, 15:48 »

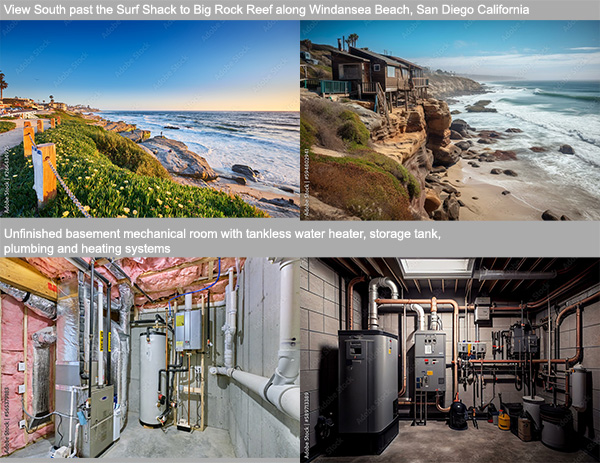

There are written Adobe Stock rules that genAI images should not say it's a real place: "Don�t: Describe AI-generated content as depicting real people or places." There are many thousands of examples of photo-like images supposedly of real towns or landmarks already in the collection and it's really unhelpful to customers who do the default search (which includes genAI images) to have no clue looking at the results that what purports to be Memphis, Fresno, London, the Eiffel Tower, Yellowstone, Austin, TX, etc. etc. isn't really. The existing model for overlays on Editorial and Premium images (lower left of the thumbnail) would work well IMO and would alert buyers who don't even realize there is now AI content at Adobe Stock. They could then exclude genAI images for searches where it matters that the place they're searching for is depicted as it exists. I did an example for a search for cliffs of moher which has a lot of recent AI uploads that could not be used if you were doing tourist promotions for that area of Ireland. Click for larger image  I started thinking about this when I saw an AI image labeled as Windansea beach in California and it clearly wasn't. I've been there. Then I realized the description looked familiar and looked at one of my images of that area. It was copied verbatim by the AI uploader. The same thing had happened a few months back with a very different image of mine. Here are the pairs of images - it's not hard to guess which is the real one and which AI   I have no skin in this game - my images will continue to sell as long as the photo-realistic AI images of specific places are so useless - but from a buyer's perspective, if you want Tower Bridge in Sacramento, the genAI versions are 100% useless and just need to be clearly marked so the unwary buyer doesn't make an a$$ of themselves with Adobe Stock's help. Although I do have some skin in the game - I don't want buyers walking away from Adobe Stock because they no longer feel safe licensing images there.

12

« on: July 11, 2023, 14:15 »

https://www.newswire.ca/news-releases/shutterstock-expands-partnership-with-openai-signs-new-six-year-agreement-to-provide-high-quality-training-data-872644267.htmlThe stock's up this afternoon, so investors must feel it's a good deal for them  "OpenAI has secured a license for access to additional Shutterstock training data including Shutterstock's image, video and music libraries and associated metadata" "Shutterstock's high-quality content library, enriched with vast metadata, leads the industry in size, diversity and annotation�making it unrivaled for training AI capabilities." https://techcrunch.com/2023/07/11/shutterstock-expands-deal-with-openai-to-build-generative-ai-tools/"Stock content galleries like Shutterstock and generative AI startups have an uneasy � and sometimes testy � relationship. Generative AI, particularly generative art AI, poses an existential threat to stock galleries, given its ability to create highly customizable stock images on the fly. Contributors to stock image galleries, meanwhile, including artists and photographers, have protested against generative AI startups for what they see as attempts to profit off their work without providing credit or compensation." https://www.cnbc.com/2023/07/11/shutterstock-stock-up-on-openai-deal.htmlLove the jargon - the shares "popped" today  Edited July 13 to add today's closing stock price - $56.95 -and some comments from The Verge https://www.theverge.com/2023/7/11/23791528/openai-shutterstock-images-partnership"Unlike other image-sharing platforms like Getty Images, Shutterstock is fully embracing AI � and all the consequences that may come with it. Artists have expressed concerns about their work getting scraped to train AI models, which Getty Images has addressed by banning AI-generated content from its platform completely. ... While Shutterstock may see its library grow through its integration with DALL-E, it might not save the platform from the legal gray area surrounding AI-generated content."

13

« on: June 26, 2023, 14:43 »

This topic has veered wildly away from tracking genAI collection sizes. I've moved it to the Off Topic section and will discontinue weekly updates on size information

I thought it might be useful to keep track of the size of the AI generated images over time. Here are the numbers I gathered this afternoon (26 Jun 2023)

Adobe Stock AI collection

10,860,621

Dreamtime AI collection

2,937,151

CanStock collection (search for "generative ai")

752,558

Shutterstock collection

646,692

123RF collection

502,652

iStock collection (keyword "AI Generated Image"; not sure what that really means)

167,370

DepositPhotos collection (search for "generative ai")

100,211

3,597 vectors

2,410 photos

2,377 illustrations

205 videos

14

« on: June 07, 2023, 12:09 »

I'd never heard of Z2U (I'm not a gamer) but they appear to be selling Shutterstock, Adobe Stock and iStock accounts and assets. I'm not sure if selling your account is contrary to agency terms (sort of like sub-leasing an apartment), but selling individual items is reselling what the agency licensed to you, and that's always against the agency terms even if they don't bother to chase up the offenders (search here for reports about Fiverr which has gigs reselling stock agency images) https://www.z2u.com/shutterstock/accounts-5-16848This is the platform's description of that category: "The places where users buy Shutterstock Premium Account will generally be the site with the most users, for a number of reasons. One of which is that more sellers means more competition, which in turn, means lower prices as sellers compete to make sales. And it's important to find a reputable and trusted player-to-player trading platform since there are lots of scam sites out there that will not only steal your money, but also your personal data. We Z2U.com is the most secured trading platform for you! We always audit sellers' reputation and delivery speed, ensuring your buying safety! We take full responsibility for the entire selling and buying Shutterstock Image subscription, FLEX 25 mixed-asset subscription & On-demand packs" https://www.z2u.com/adobe/accounts-5-16487?keywords=Adobe%20StockThey have a lot of other offerings just for Creative Cloud subscriptions, not stock https://www.z2u.com/istock/accounts-5-17471"We Z2U.com have been in the industry of in-game asset exchange for over 10 years so we know how to attract the right sellers and drive a bargain. Here, you will find our sellers setting prices that allow you to pick out the best offer and review the sellers trust score, so you know you are dealing with someone worthwhile. All the products are provided by real users of iStock, 100% safe, no hack, no cheats! iStock Basic, Premium & Video Subscription Accounts for Sale, feel free to contact our 24/7 live support if you have any issues!" I didn't find any mention of this platform when I searched here, so I have no idea if this has been brought to any agency's attention before, but I think anyone involved in this type of trading should have their agency account closed. At a minimum, the agencies should contact Z2U (who appear to be in China based on the country code of their WhatsApp number) to tell them they have to shut down these sales. Has anyone had any dealings with this platform? Reviews are all over the place https://www.trustpilot.com/review/www.z2u.comhttps://www.reddit.com/r/Scams/comments/f1diwu/is_z2u_legit/https://www.hackread.com/z2u-market-leak-expose-illicit-services-malware/

15

« on: June 07, 2023, 09:59 »

https://www.prnewswire.com/news-releases/shutterstock-announces-share-repurchase-program-301844432.htmlUnsurprisingly, SSTK is up this morning - it had been wallowing around in the high $40s recently and it's now at $52.26 From the CEO: "Given our strong free cash flow generation and healthy balance sheet, Shutterstock is uniquely positioned as a technology company to be able to invest for organic and inorganic growth while also consistently returning value to shareholders through a mix of dividends and share buybacks," They've authorized up to $100million, and apparently can borrow to fund this cozy-up-to-the-shareholders scheme: "The Company expects to fund repurchases through a combination of cash on hand, cash generated by operations and future financing transactions." I guess Oringer would love to get more for his program of stock sales he still has 11,370,600 left. June 2nd he sold nearly $4million and the price in the low $50s was way down from the April sale in the $70s https://finance.yahoo.com/screener/insider/ORINGER%20JONATHANHaving squeezed contributors as tightly as they dare and banged the AI drum as loudly as they could the stock price wasn't going up as they'd hoped... Tossers! Edited to add: The stock closed today (Wed June 7th) at $50.63, up only a few cents from yesterday's $49.99 close; it's $50.20 in after hours trading. I guess the buyback exuberance fizzled. June 8th close $49.80 (and the markets were up; this was about SSTK specifically, not general doom & gloom) June 16th close $49.13 (and Oringer sold nearly $5million more stock on June 7th at $50-$53 per share)

16

« on: May 23, 2023, 12:45 »

"Through the GIPHY acquisition, we are extending our audience touch points beyond primarily professional marketing and advertising use cases and expanding into casual conversations" https://investor.shutterstock.com/news-releases/news-release-details/shutterstock-acquire-giphy-worlds-largest-gif-library-and-searchhttps://investor.shutterstock.com/static-files/2899adce-d747-4cc5-964f-8a2134df94c7https://finance.yahoo.com/news/meta-sells-giphy-53m-shutterstock-165241138.htmlThe blurbs include mention of Sponsored GIFs - which I assume means that while end users won't pay, companies will pay SS to create custom (brand-focused) GIFs, hoping for a viral moment. If you can figure out what this word salad means, then you know how SS will make its $53 million back: "We expect to execute against multiple monetization opportunities across advertising, content and distribution" Some comments https://techcrunch.com/2023/05/23/meta-sells-giphy-to-shutterstock-for-53m-after-uk-divestment-order/WSJ (paywall) "Shutterstock said it plans to fund the deal, slated to close in June, with cash on hand and its revolving credit facility, adding that Meta is entering into an API agreement to ensure continued access to Giphy�s content across its platform." https://www.wsj.com/articles/facebook-parent-meta-agrees-to-sell-giphy-for-53-million-on-regulators-order-7b1c2ec6https://www.theverge.com/2023/5/23/23734220/shutterstock-giphy-meta-cma-uk-antitrustFrom The Verege article: "For Shutterstock, the deal will augment its content library, expanding it to include GIFs and Stickers. The company also said it would help its �generative AI and metadata strategy.� That�s a bit more vague, but Shutterstock is currently using generative AI to provide imagery to its customers. Acquiring Giphy�s substantial library could theoretically give Shutterstock reams of training data for future AI-based products." From the Variety story "This is an exciting next step in Shutterstock�s journey as an end-to-end creative platform..." https://variety.com/2023/digital/news/giphy-sold-meta-shutterstock-1235622548/From Engadget: " "This may affect Shutterstock's customers, though. Chief executive Paul Hennessy hopes Giphy will help commercialize Shutterstock's GIF collection � don't be surprised if animated images play a prominent role in Shutterstock's offerings." https://www.engadget.com/metas-paid-verification-system-comes-to-the-uk-162523922.html

17

« on: May 18, 2023, 10:06 »

Shutterstock held a virtual "showcase" Wednesday afternoon and the video is up on YouTube https://www.youtube.com/watch?v=RbZ5q3X6MSYI watched some of it (and skipped some) and noted a couple of interesting things. Skip Wilson hosted (VP Brand Marketing, formerly at Peloton). About 2 minutes in, a panel discussion led by the chief product officer ostensibly about creative possibilities with AI. Ms. Schoen layered the buzzwords - disruption, innovation, etc. - and said "...generative technology is magical..." Please... There really wasn't much real content - panel members were from Peloton, NVIDIA and AWS. Perhaps Skip Wilson's prior gig was why Jackie Moore, a producer from Peloton was there. She said she couldn't talk about the specifics but they were using AI in their production (so why have her on the panel??). I listened for a bit but then skipped to the next segment. About 30 minutes in, Skip Wilson announces a partnership with AI for Good - responsible AI, blah, blah... https://www.prnewswire.com/news-releases/shutterstock-and-itus-ai-for-good-collaborate-to-advance-responsible-ai-301826531.htmlAt about 33 minutes, an interview with Joh Reynolds (artist, https://twitter.com/ArtByJah) about his use of AI About 43 mins is a product announcement/demo of an AI design assistant which looks pretty interesting. The slightly over-eager chat from the bot could get old fast, but it looks like it might be useful to customers with no design staff. At 51 minuets there's a final panel discussion. They emphasize their ethical approach to AI and talk about the contributor fund and how Shutterstock "helps" artists make money from their work. There was a discussion of the process of offering customers indemnity for the work they generate and then license through SS. It appears they'll run the output through their inspection process and if the content passes, the customer will have legal indemnity from SS in the event there's a lawsuit. The discussion contrasted how SS's approach to generative AI was different in that they're doing it ethically and compensating contributors (no mention that they did the initial training before telling anyone about it). That's certainly Adobe's pitch too. Based on my experience with Firefly beta, Shutterstock will clean Adobe's clock with their design tool. The demo was undoubtedly showing off a carefully scripted and tested scenario, but Firefly is an exercise it time consuming frustration trying to get anything usable that's even close to what the prompts asked for. You can join their waitlist to try the creative AI tool https://www.shutterstock.com/ai-image-generator

18

« on: May 15, 2023, 18:01 »

Email arrived this afternoon announcing editorial subscriptions at SS. I wasn't sure why that was new, but looking at the pricing page for editorial images (I think this is unrelated to editorial use only images in the main collection), they only had per image -single or multi-pack - at $199 or $99 per image.

There's no info on the price for these enterprise subscriptions (I clicked on the Subscribe link but you have to fill out a form and someone will contact you) but I'm guessing it'll be less than the image packs. Which will mean lower royalties for contributors.

If anyone has more information about how this is priced, please post.

19

« on: May 13, 2023, 14:19 »

On Wednesday, as part of Google's I/O event, Adobe announced their partnership: "Today we announced that we�re bringing Firefly to Bard by Google with the ability to continue your creative journey in Adobe Express, to inspire millions of people to create. In the coming months, Firefly will power and highlight text-to-image capabilities in Google�s experimental conversational AI service, with the ability to continue your creative journey further in Express. Users of all skill levels will be able to describe their vision to Bard in their own words to create Firefly generated images directly in Bard. After you generate an image with Firefly, you will have the ability to edit and further modify it using Express, making it easy to create standout content with inspiration from Express�s beautiful, high-quality collection of templates, fonts, Stock images and assets." Up till now, if you downloaded an image you generated with Firefly beta, (a) it had a watermark and (b) was not authorized for commercial use. Is that true for the output from Bard/Firefly/Adobe Express? "Stay tuned in the weeks ahead for updates on Firefly and more exciting features coming to Express!" I think it's more than time for an update for contributors on when they might see compensation, or at least a plan. We should not just be an afterthought as the execs make deals. What exactly is holding up the compensation model announcement? We were asked to be patient while beta was underway (although it would have been preferable to have to consulted before the training was done), but announcing a big new partnership, trumpeting the main advantage to be the rights to their (our) content, makes it clear the marketing messages are Adobe's priority, not the reality of putting a compensation plan in place. https://blog.adobe.com/en/publish/2023/05/10/adobe-firefly-adobe-express-google-bardHere's some more coverage of this announcement: https://techcrunch.com/2023/05/10/google-partners-with-adobe-to-bring-art-generation-to-bard/https://petapixel.com/2023/05/10/google-is-integrating-adobe-firefly-and-express-into-bard-chatbot/https://www.forbes.com/sites/barrycollins/2023/05/10/google-bard-boosted-with-adobes-ai-art/?sh=1f00687f31efhttps://www.engadget.com/google-is-incorporating-adobes-firefly-ai-image-generator-into-bard-174525371.htmlhttps://www.fastcompany.com/90894359/google-and-adobe-firefly-bard-partnershiphttps://www.techtarget.com/searchcustomerexperience/news/366537328/Google-adds-Adobes-image-generator-Firefly-to-BardIt's lovely that the press coverage is emphasizing the ethical basis for Firefly - our content uploaded to Adobe Stock - but that has to be backed up with a plan and actual compensation. From the TechTarget article ""It's an interesting example of how training data may be the most important differentiator between AI services rather than usability or output,"" From the FastCompany article: "THE ETHICAL ADVANTAGE There�s something unique about Google and Adobe�s play: The ethical aspect. Google explains that �unlike any other Generative AI tool available today, Firefly is designed to generate images that are safe to use in commercial settings once the model is out of public beta, free from copyrighted materials like popular cartoon characters and branded content.� The secret to Adobe�s sauce is that Firefly is trained on hundreds of millions of professional-grade, licensed images in Adobe Stock, which is a critical aspect in obtaining not only high-quality images but material that respects copyright owners. " I'm not feeling respected today...

20

« on: May 03, 2023, 15:40 »

I looked around to see if there was any bad news about the agency that might have spooked the stock market, but didn't find anything. The stock closed at $54.91. The DOW and Nasdaq were only down a fraction (about 0.50%); tech stocks were mixed but were +/- 1%; Adobe's stock was down 6.35% but I'm guessing that was about its Figma acquisition running into regulatory problems, not something related to their agency. I looked at LinkedIn to see if Paul Hennessey had moved on, but apparently not  . Their Q1 numbers were decent and they upped their dividend to 27�. Does anyone have any idea why investors are unhappy?

21

« on: April 23, 2023, 17:17 »

Canva has released a "report" on the visual economy. It reads to me like a marketing piece for Canva - the survey behind some of the so-called stats seems very squishy. 85% of decision makers say pictures are cooler than words... Teaser https://canvavisualeconomy.com/Report https://www.canva.com/design/DAFfSbzYlmY/iWAW-iVnR1q925CeYOV8CQ/view?utm_content=DAFfSbzYlmY&utm_campaign=designshare&utm_medium=link&utm_source=publishsharelinkSample customer testimonial from the CMO of reddit "Canva has been a valuable tool to speed up and streamline our creative team's processes. It helped our creative team shift their time from one-off bespoke requests to high-leverage brand systems and programs. We�ve saved over 21,000 hours of design time in just six months after the internal adoption of Canva" The very busy moving chart that says that Brazil has has the most Canva designs published of any country seems to illustrate how pointless most of this is - as far as I know Brazil is still pretty much the same as before it lead the world in published Canva designs. I didn't know that 90% of global business leaders use digital whiteboards at least once a week - exhibit M in the pointless factoids parade... At some point I just couldn't take it any more so I stopped reading  But you may have a stronger constitution than I do...

22

« on: April 19, 2023, 12:51 »

https://www.globenewswire.com/news-release/2023/04/19/2650115/0/en/Stock-Photography-Marketplace-Vecteezy-Enters-Into-Exclusive-Deal-with-Shutterstock-to-Further-Unlock-Visual-Storytelling-Content-for-Marketers.htmlI wondered why SSTK was down today (71.33-2.39 (-3.24%) As of 01:35PM EDT. Market open.) and the first article on Yahoo's page for their stock was a link to the announcement above. That doesn't show up on SS's press release page for whatever reason. There's not a lot of detail about what exactly the deal means. Buzzword salad says: "With this partnership, the millions of designers, marketers and entrepreneurs that regularly visit Vecteezy in search of affordable stock imagery will have access to even more files through the high-quality Shutterstock images that will populate alongside those already on Vecteezy. This partnership increases the total number of premium and relevant results on Vecteezy and creates a shared pipeline of high intent visitors between the two brands." Looking at Vecteezy's paid plans, you can get up to 73,000 images a year for $108 - and note the "unlimited" downloads that allows up to 200 downloads per day!! Do the math and that would come to a price of $0.001479 - about 0.15� (note that's fractions of a cent) It's possible the stock market is gloomy about Shutterstock today for some other reason, but we may learn more next week (Apr 25) when they reveal their Q1 2023 results.

23

« on: April 11, 2023, 13:49 »

https://www.prnewswire.com/news-releases/trillium-capital-issues-open-letter-to-getty-images-board-301794027.htmlI can't imagine any of the suggested actions Trillium lists would bring about anything good for the business long term or contributors, short or long term. Getty did two rounds with private equity owners and IMO current woes can be traced back to that * era. Sale to a "strategic buyer" seems unlikely - they ended up with the SPAC deal because they couldn't find one of those as I recall. "A substantial cost restructure and reduction in labor should be announced and implemented by Getty." - Royalties are costs to agencies... Paying down debt sounds great, but they wouldn't have all that debt except for the prior iterations of looting. And as for a debt restructure so they can do stock buybacks, I'm left speechless (not really - it's a terrible idea for everyone except those hoping to sell their shares and get out). They also ding Getty execs with doing a poor job courting the investor community and think they need to buy more stock on the open market so they have more "skin in the game". Getty's stock is down 6.55% so far today - I assume as a reaction to this investor letter? Not much that contributors can do about this, but it's worth staying aware of the businesses which license our work.

24

« on: April 11, 2023, 09:43 »

I missed this blog post announcement from March 9th: https://www.behance.net/blog/sell-downloadable-assets-on-behanceI took a look around to see what fees the platform charged for items sold there: https://help.behance.net/hc/en-us/articles/13356478351387-FAQ-What-are-the-fees-The payment processor (Stripe) takes a cut, but Adobe takes only 30% - versus we get only 30% for licenses via Adobe stock. That left me wondering about more than having an outlet for file types I can't license via Adobe Stock (I have some PSD files at Pond5 for example, which is great except for Pond5 sales being more rare than hen's teeth). This blog post says you can still license on other sites (i.e. it's not exclusive): https://www.behance.net/blog/get-paid-on-behanceFrom the above (emphasis mine): "You can specify the type of license, set your own price for each asset, and continue to monetize on other platforms." Does this mean I can license items on Behance that I also license on Adobe Stock? I'm thinking of a scenario where the JPEG is licensable on Adobe Stock, but a PSD with some additional features is for sale on Behance? The license offerings are different (simpler) https://help.behance.net/hc/en-us/articles/7416981176603-License-Types-for-AssetsThe FAQ makes it clear that transactions are between the seller and purchaser - i.e. Adobe doesn't get involved (other than collecting the platform fee and "... we will promote your content to our audience of 40 million members. "). From the link below "All transactions on Behance are between the purchaser and the creator. If any issues arise or you want to request a refund, you should contact the creator directly" https://help.behance.net/hc/en-us/articles/12810196558107-Learn-more-about-transactions-on-BehanceI'm not sure about investing the time in setting up shop on Behance, but it'd be nice to have something in the FAQ specifically addressing any issues that apply to Adobe Stock contributors who also sell through Behance

|

Sponsors

Microstock Poll Results

Sponsors

|